Table of Contents

Dubai to India Money Transfer

UAE has more ex-pat population than UAE nationals and Indian tops the ex-pat population. Currently (May 2020), there are over 2.5 million Indians staying in UAE, which is more than 25% of UAE population. Dubai to India Money Transfer

That is the reason, you will observe a more competitive exchange rate of AED to INR as compared to other currencies to INR.

Ways to send money from UAE to India

- Banks offer comparatively low rates and also charge an additional charge so it is not a very economical option.

- Local dealers are limited in numbers and it is not an easy task finding a reliable dealer.

- Online remittance companies that are reputable and have good customer reviews are the best. They offer document free transfer and high exchange rate.

Comparing available options

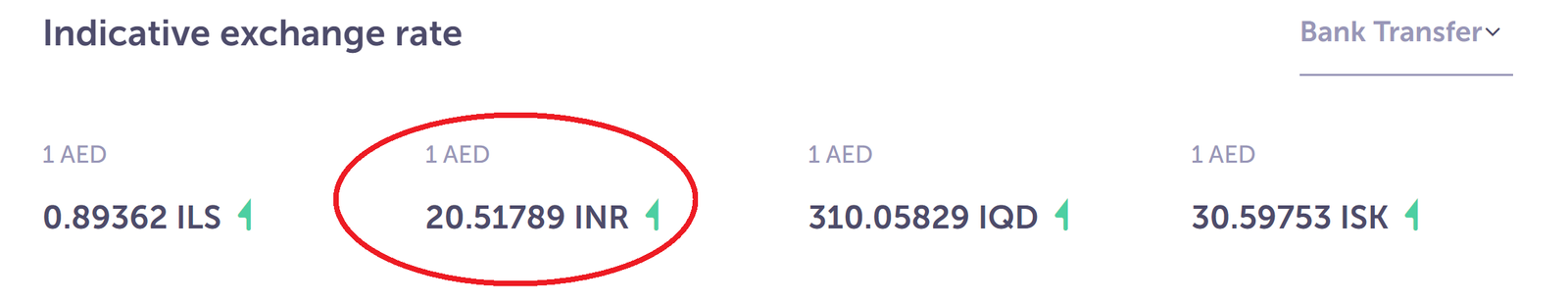

Now let’s compare the available option for sending money from Dubai to India. The current exchange rate for AED to INR

1. Transferwise (Free Transfer link)

TransferWise is an online account that lets you send money, get paid, and spend money internationally. With a TransferWise account, you can send money abroad, get paid in other currencies, and spend abroad on the TransferWise debit Mastercard. Hold and convert your money in 28 currencies. And always get the real exchange rate.

Google Play : 4.5 Star (64,599 ratings)

Transferwise gives almost the same rate as shown by google. So if you choose transferwise to send 1000 AED to India, it will have to bear the loss of

Change from actual – 20658 INR -20637 INR = 21 INR

2. Transfer using UAE Exchange (check exchange rate)

Change from actual – 20658 INR – 20517 INR = 141 INR + Additional charges

3. Transfer using Currency Fare (check exchange rate)

Change from actual – 20658 INR – 20515 INR = 143 INR + Additional charges

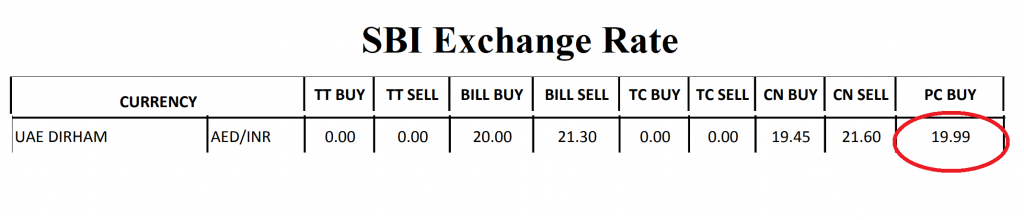

4. Transfer using SBI (check exchange rate)

As I said earlier, the bank exchange rates are poor and they also need additional documents.

Change from actual – 20658 INR – 19990 INR = 668 INR

5. Transfer using ICICI Money2India (check exchange rate)

Change from actual – 20658 INR – 20500 INR = 158 INR + 15 AED charge (extra)

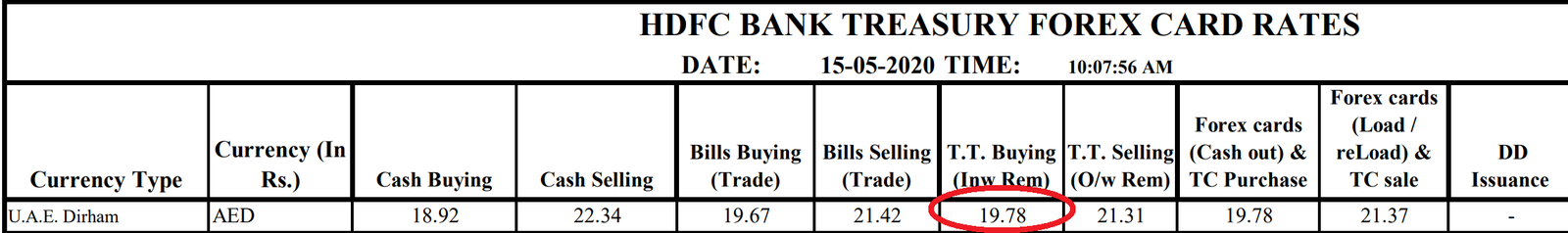

6. Transfer using HDFC (check exchange rate)

Change from actual – 20658 INR – 19780 INR = 878 INR

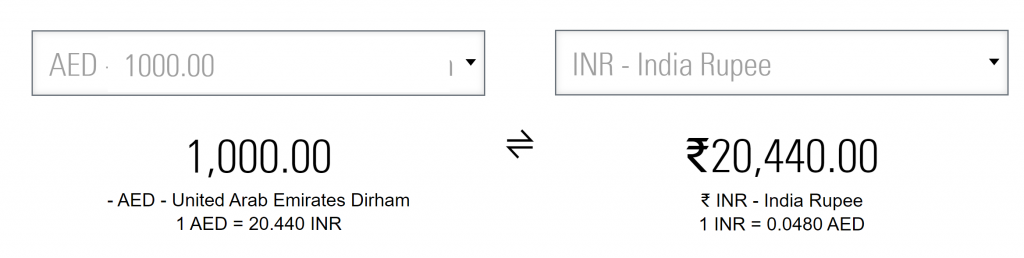

7. Transfer using Western Union (check exchange rate)

Change from actual – 20658 INR – 20440 INR = 218 INR + Additional charges

8. Other options (check exchange rate)

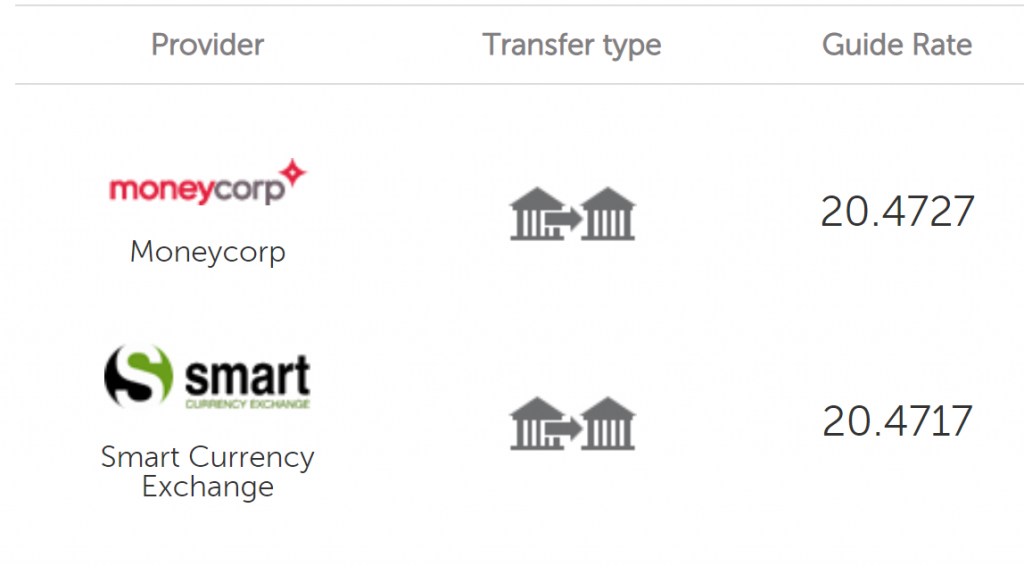

MoneyCorp – 20658 INR – 20472 INR = 186 INR

Smart Currency Exchange – 20658 INR – 20471 INR = 187 INR

Concluding remarks

Transferwise is the best option available to send money from UAE to India. But if you are sending a higher amount and need it quickly then you would be required to verify online with documentation which may take 1-2 days. In that case, you can visit the nearest Western Union. You shall also consider spending your precious time and money on traveling to these branches.

You shall also consider talking to your bank if they any cheaper options. Most of the time bank transfers are 2-3 times more costly to these online-based platforms.

Keywords: dubai to india money transfer time, how to send money from dubai to india Quora, money exchange in Dubai, best rate to send money to India, best time to send money to india from use, free online money transfer from uae to India, uae exchange, money transfer rate from dubai to india, how to send money from dubai to india Quora, how much time it takes to transfer money from dubai to India, uae exchange online,best time to send money to india from uae, money exchange in Dubai, money transfer to India, how to send money from uae to india through uae exchange